UK commercial vehicle output continues growth with best July for six years

SMMT

AUGUST 25, 2022

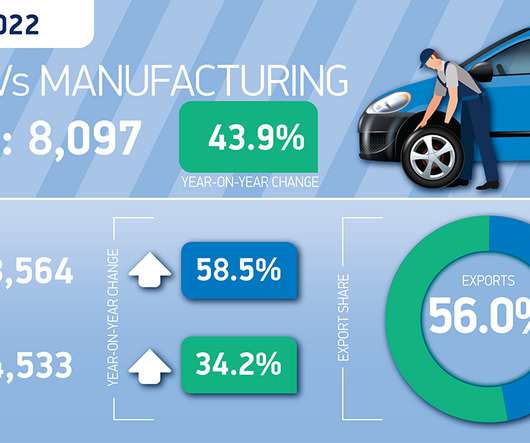

since January, at 58,693, the best year to date since 2012. above the pre-pandemic five-year average and the best January to July performance since 2012. CV production January-July 2012: 65,100 units. Overseas demand increases by 34.2%, while production for Britain’s CV market grows by 58.5%. UK manufacturing is up 46.9%

Let's personalize your content