The robotics industry is experiencing sustained growth worldwide, with China in the lead. Germany ranks fourth. Pandemic-induced supply chain bottlenecks for established manufacturers are leading to a slow clearing of full order books – one of the reasons why Chinese robot manufacturers are in higher demand than ever before. Another option is purchasing used units.

The World Robotics Report recently published by the International Federation of Robotics (IFR) indicates that the robotics industry continues to be on the rise. This is evidenced by the ever-increasing number of newly installed units as the most important key figure for the industry. Over half a million new installations worldwide in 2022 represent a solid growth of 5%. Nearly three-quarters of these new installations were commissioned in Asia – by far in first place, followed by Europe with 15% and the Americas with 10% new robotic units.

Current robot trends in the EU

In the European Union, Germany is the leading heavyweight. Worldwide, the country had the fourth-highest robot density in 2022 – behind Japan, Singapore and Korea. More than a third of the newly installed robots in Europe are located in German factories, followed by Italy (16%) and France (10%).

The key industries in which robots are used include automotive manufacturing, the metal industry, the plastics and chemicals sector, as well as food production. The automotive industry remains a major consumer of industrial robots, with Germany standing out. However, cyclical investment behaviour was observed, leading to a decline in installations in Germany and Italy in 2022. In the other sectors, installations continued to increase, returning to pre-pandemic levels.

Supply chain challenges and the rise of China in the robotics market

Supply chain bottlenecks present a dilemma for many international robot manufacturers. While order books are brimming, fulfilling these orders proves challenging. This is one of the keys to the rapid rise of Chinese newcomers in the robotics industry. In addition to their adaptability to market trends and the development of scalable solutions, they benefit from a larger pool of skilled workers and government support. This dynamic has led even established international manufacturers to increasingly rely on the Chinese supply chain.

Companies like Kuka and Fanuc have already responded to these trends. Kuka recently completed the expansion of its factory in Shunde, which is now the largest robot manufacturing site in southern China. Fanuc completed the next expansion stage of its plant in Shanghai in July, making it Fanuc’s largest production centre outside of Japan.

Used robots as a cost-efficient solution in uncertain economic times

A general slowdown in global economic growth is expected for 2023. However, the robotics industry is anticipated to buck this trend. A further increase in worldwide installations is also expected for 2024 – especially in China.

In economically uncertain times, cost-efficient investment options come to the forefront. Used industrial robots offer a practical alternative to expensive new acquisitions. These are not only more affordable but are also immediately available.

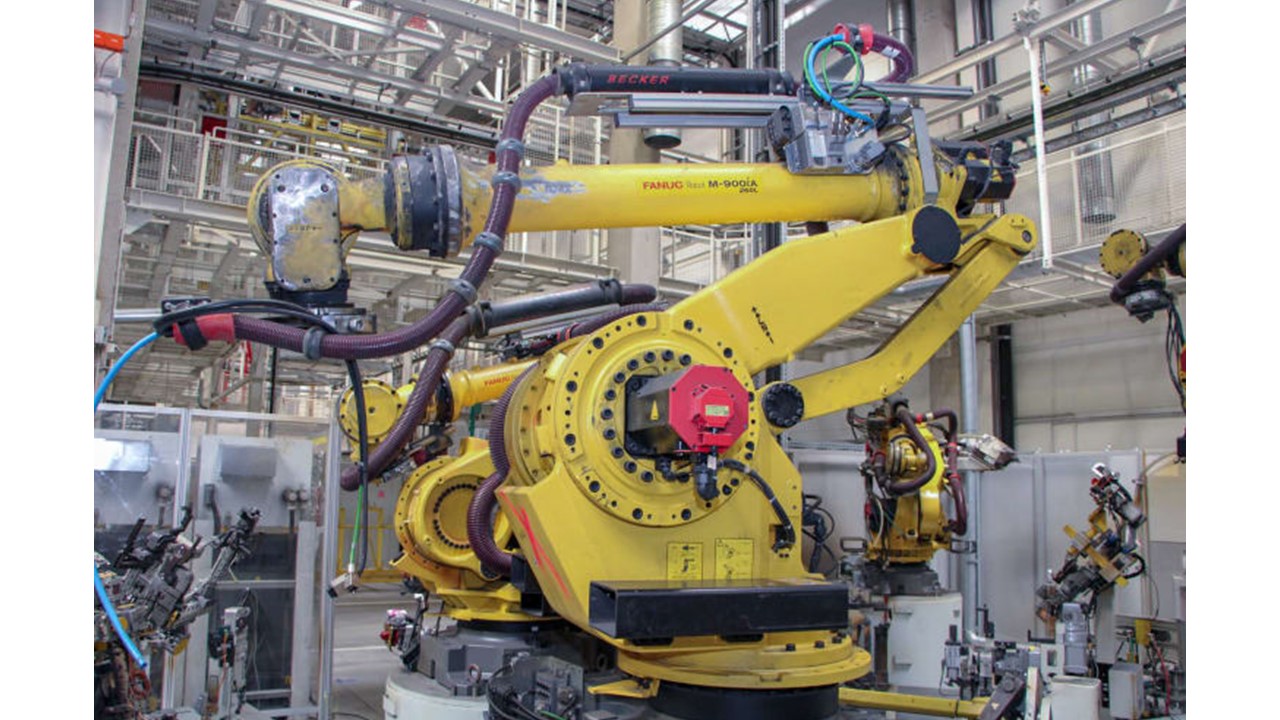

At the international industrial auction house Surplex, an auction featuring market-leading robots from Fanuc and Kuka is imminent. On 24 October, nearly 30 robots from a Czech automaker will be up for auction. They come from the restructuring of the production site in Hodonín, Czech Republic. For example:

- FANUC M-900iA/260L

- FANUC R-2000iB/210F

- KUKA KR 210 L150-2 2000

- KUKA KR 210 R3100 ultra

- KUKA KR 210 L180-2 2000

There are no reserve prices in this auction, offering the opportunity to acquire high-quality industrial robots at particularly favourable conditions.

For more information, visit Surplex.com.