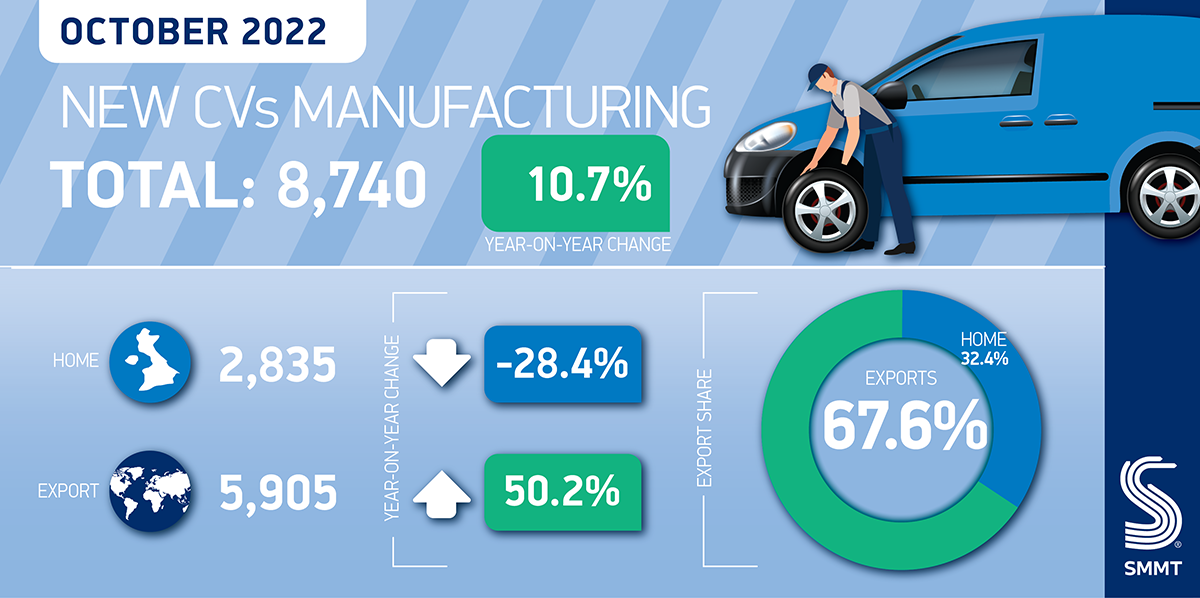

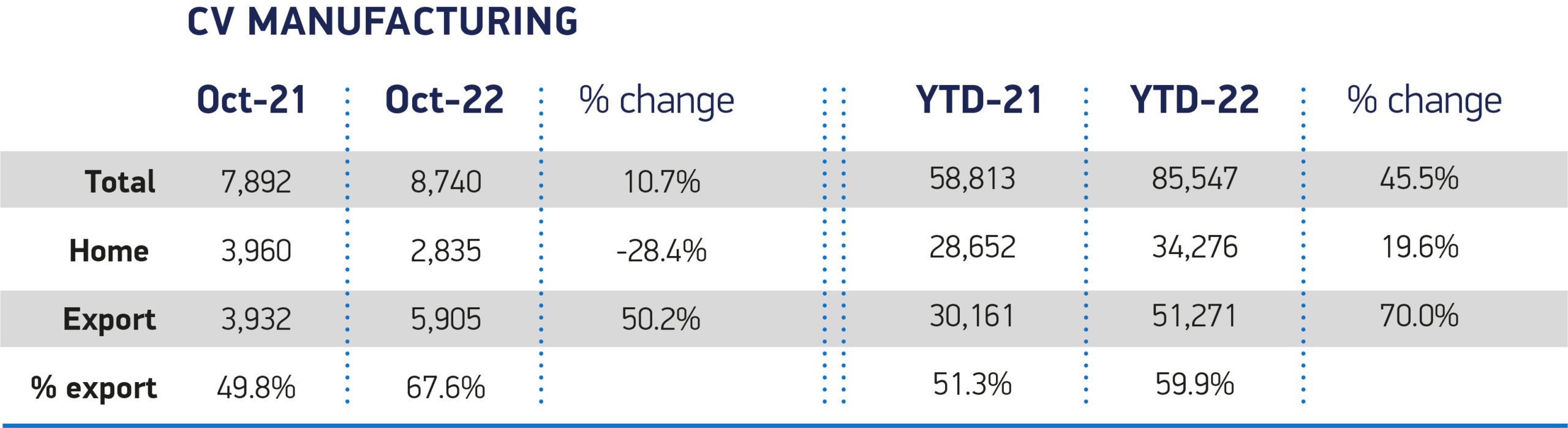

- UK CV production rises 10.7% to 8,740 units, marking best October since 2019 and 10th consecutive month of growth this year.

- Overseas demand grows by 50.2%, while production for domestic market falls -28.4%.

- Year-to-date output increases 45.5% to 85,547 units, resulting in best performance since 2012.

UK commercial vehicle (CV) production grew by 10.7% in October, with 8,740 vans, buses, trucks, coaches and taxis rolling off British factory lines, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT). Output in October was the highest for the month since 2019, as production volumes increased to round off 10 consecutive months of growth this year.1

Exports continued their double-digit rise, increasing by 50.2% to 5,905 units thanks to strong demand from overseas markets. Some 5,579 units were destined for Europe (94.5% of exports), evidence of how Britain’s CV manufacturers continued success is contingent on suitable trading terms, and a globally competitive business framework, which will bolster operator confidence. Meanwhile production for the UK fell sharply, down -28.4% compared with the same month last year, as firms focused on fulfilling strong export orders.2

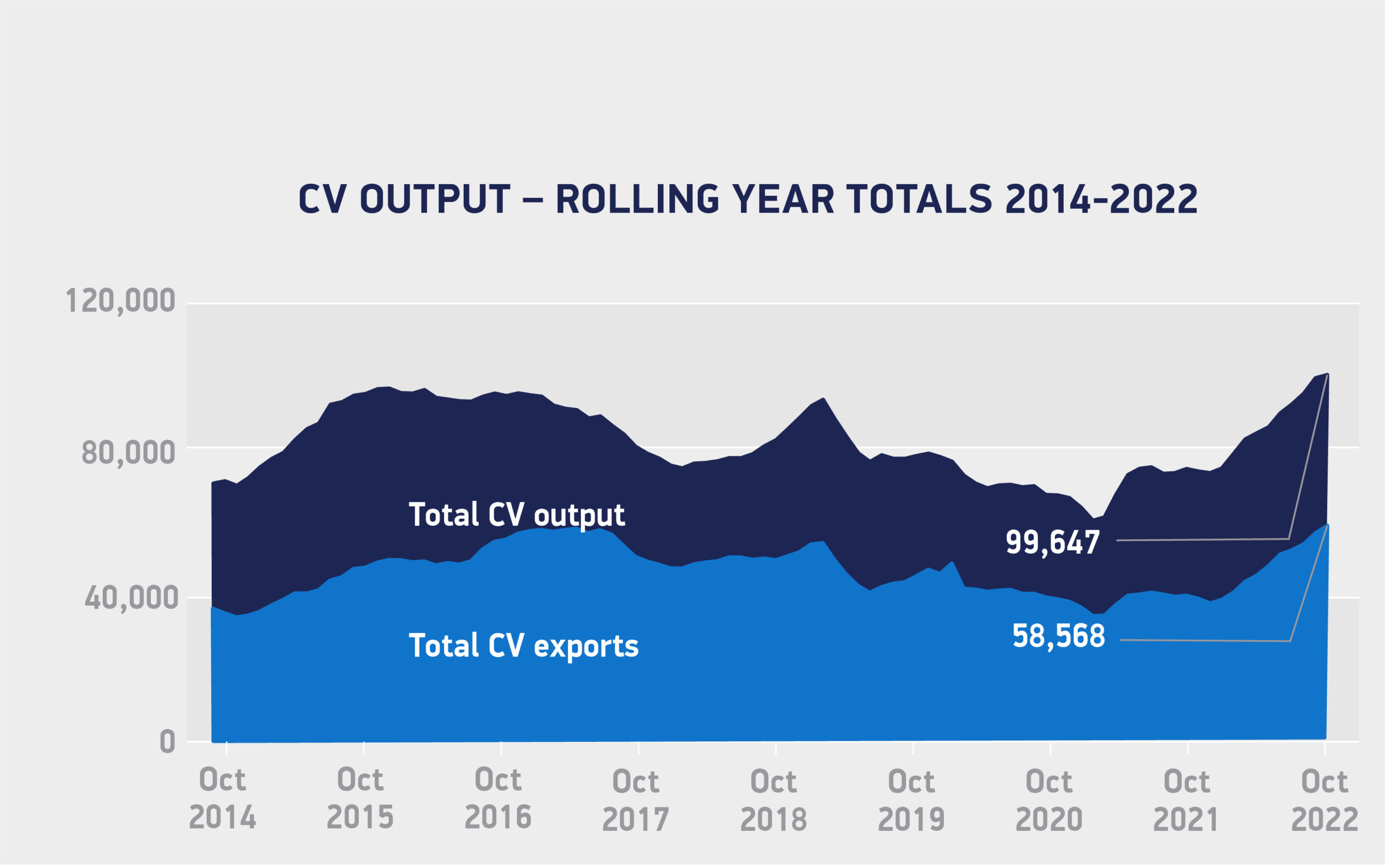

Even as UK CV manufacturers have juggled turbulent global supply chains, overall production is up 45.5% year-to-date, with 85,547 CVs built in Britain since January. Robust overseas demand means that exports have risen by 70.0%, to 51,271 units so far this year, while production for domestic buyers is up a more modest 19.6%, to 34,276 units. To date, 2022’s performance represents the best ten months of a year since 2012 and is some 19.3% higher than the pre-pandemic five-year average.3

Mike Hawes, SMMT Chief Executive, said,

Another month of growth for CV manufacturers is good news for the wider industry as it shows how the UK is well placed to build high-quality vehicles which support jobs, growth and exports. While the industry looks to 2023 with some optimism, we cannot be complacent as sustained long-term growth is dependent on favourable operating conditions and a competitive framework for automotive manufacturing

Notes to editors

1 October 2019: 9,087 units

2 October 2021: 7,892 units

3 Pre-pandemic five-year average CV (2015-19): 71,716 units