Automotive OEMs that successfully integrate carbon net-zero strategies across their value chains will not only achieve regulatory compliance but also secure strategic leadership in a decarbonized global economy.

By Thanigesh Arumugam Parthasarathi, Team Leader – Mobility

Carbon neutrality has become a key priority for global automotive OEMs. Regulatory frameworks in major markets—such as zero emission vehicle (ZEV) mandates, emissions caps, and carbon disclosure requirements—are accelerating the shift toward decarbonized production systems and cleaner vehicle technologies. Compliance with these frameworks has become fundamental to market access and long-term competitiveness.

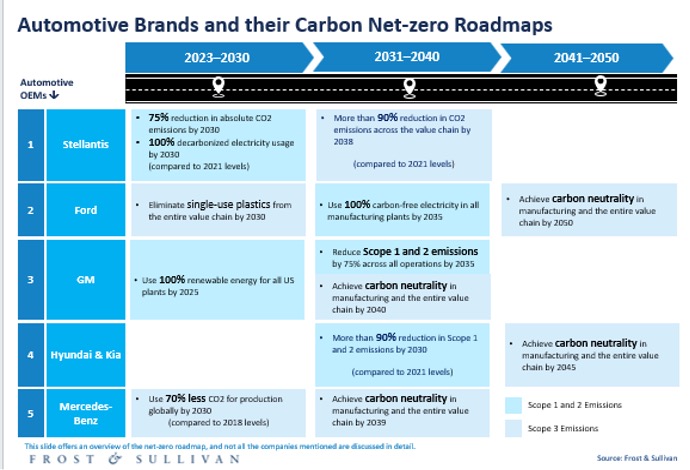

In response, OEMs are adopting several net-zero strategies, such as vehicle electrification, renewable energy sourcing, closed loop recycling, and sustainable supply chain practices. For instance, companies including Volkswagen, Ford, Hyundai, and BMW are investing in low-carbon material procurement, life cycle assessments (LCAs), and factory decarbonization initiatives. These strategies are aligned not only with emissions reduction goals but also with broader sustainability mandates.

The industry’s strategic pivot is being further reinforced by investor expectations, rising ESG scrutiny, and growing consumer demand for transparency. Consequently, carbon neutrality is increasingly being integrated into brand positioning and product development, positioning sustainability as a core driver of long-term value.

To learn more, please see: Carbon Net-zero Strategies in the Automotive Sector, Global, 2024–2030, or contact sathyanarayanak@frost.com for information on a private briefing.

Transformative Forces Shaping Strategic Priorities

External factors like emissions regulations, geopolitical uncertainty, and digital transformation are influencing the structure and pace of carbon neutrality efforts across the industry.

North America, the EU, and China are implementing stricter emissions policies, compelling automakers to accelerate the transition to ZEVs. ZEV credit systems and emissions multipliers have now become central to compliance strategies. In the EU and U.S., renewable energy adoption in manufacturing is projected to exceed 50% of the total energy mix by 2030.

Meanwhile, geopolitical volatility, supply chain disruptions, and energy security risks are driving OEMs to adopt energy self-sufficiency measures. Companies are boosting investments in on-site renewable generation through solar, wind, and biogas. These investments are reducing operational risk while advancing SDG-aligned climate resilience goals.

Digital technologies are enabling real-time emissions monitoring, energy optimization, and transparent material tracking. Predictive maintenance, blockchain traceability, digital twins, and AI-driven analytics are being integrated into plant operations and supply chain management. These tools are expected to become standard across the industry within the next five years, providing both operational efficiencies and regulatory compliance support.

Key Drivers and Emerging Constraints

Electrification remains the main mechanism for decarbonizing vehicle fleets. However, this brings with it challenges related to cost, battery material sourcing, and infrastructure readiness. While OEMs continue to scale battery electric vehicle (BEV) offerings, there are persistent concerns about the environmental impacts of raw material extraction and long-term battery disposal.

Green hydrogen is emerging as a complementary technology with OEMs such as Toyota and Hyundai piloting hydrogen fuel cell models. That said, high costs and limited refueling infrastructure are likely to restrict their commercial viability in the near term. Carbon offset programs are also in use, but most OEMs are looking at credits more as transitional tools rather than as core solutions.

On the manufacturing side, automakers are adopting closed loop recycling systems, lightweight material innovations, and energy-efficient assembly processes. Digital factory models are incorporating energy monitoring and waste minimization to promote sustainable practices and reduce total carbon emissions. However, these transformations involve significant capital expenditure, presenting barriers for smaller OEMs and Tier 1 suppliers.

A major challenge in the automotive industry’s march to decarbonization is the lack of regulatory standardization. For instance, the EU enforces far stricter sustainability standards than many Asian countries, complicating global compliance. Moreover, the switch over to sustainable materials such as bioplastics and plant-based composites can generate unintended consequences, such as deforestation and reduced recyclability.

Our Perspective

The automotive industry’s decarbonization agenda will generate several growth opportunities. The sustainable aftermarket will gain increasing traction as OEMs and suppliers focus on circular economy models. End-of-life (EOL) vehicle programs, parts remanufacturing, and recycled material integration will support emissions reductions as well as revenue diversification. OEMs will begin to structure aftermarket services around sustainable components, including biodegradable materials, reconditioned parts, and extended lifecycle vehicle servicing. LCA tools that track and optimize the environmental impact of aftermarket offerings will be developed.

Green consumer financing represents another key growth opportunity. To accelerate ZEV adoption, automakers will need to partner with financial institutions to offer favorable loan terms, subscription models, and zero-interest leasing. Aligned with smart city mobility initiatives, such models will spur demand for low-emission vehicles.

Integration with carbon markets will deepen, underpinned by the linking of multiple emissions trading systems and the adoption of blockchain technology. Collaboration with energy, transport, and technology stakeholders will help overcome regulatory fragmentation, while helping align carbon pricing and improving market transparency.

Ultimately, achieving carbon neutrality in the automotive industry will require systemic transformation across supply chains, manufacturing processes, aftermarket services, and financing models. Automakers will need to transition from compliance-driven sustainability to value-driven sustainability. Carbon neutrality will need to be viewed as a differentiator that enhances long-term brand equity and operational resilience. OEMs that successfully integrate carbon net-zero strategies across their value chains will not only achieve regulatory compliance but secure strategic leadership in a decarbonized global economy.

With inputs from Amrita Shetty, Senior Manager, Communications & Content –Mobility