Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

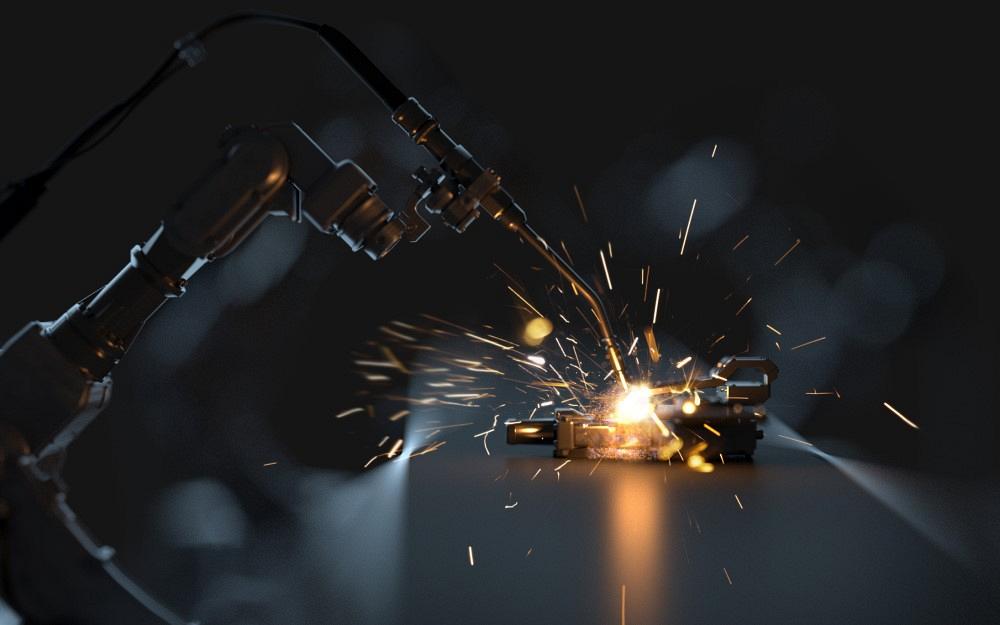

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Consolidating the curiously fragmented business of precision metal fabrication

Scaling up with automation could unleash metal fabrication’s productive potential

- By Tim Heston

- November 29, 2022

- Article

- Shop Management

The custom metal fabrication business remains fragmented, dominated by small shops that dot the country. It’s a curious thing, especially considering the financial hurdles companies face. This rings especially true in the precision sheet metal arena.

A plethora of lower-cost cutting systems, including entry-level plasma and older CO2 laser cutting machines, might be lowering the barrier to entry for some startups. But then what? A shop might upgrade to the latest equipment, maybe a high-powered fiber laser, high-end press brake, perhaps even an automated blanking and bending system. All that takes serious funding.

The annual “Financial Ratios & Operational Benchmarking Survey,” published by the Fabricators & Manufacturers Association (FMA), reveals some of the industry’s challenges. The late Dick Kallage, a longtime industry consultant who was instrumental in launching this FMA survey, said the industry suffers from “the challenge of small numbers,” especially regarding revenue concentration. The 2022 survey (covering companies’ 2021 fiscal year) reported that, on average, just six customers provide 50% of shop revenue. Difficulties with just one or two major customers can ripple throughout a fabricator’s finances. One shop might be flying high while another might be seriously suffering. During typical times, the industry has no rising tide that lifts all boats.

Of course, these aren’t typical times. 2021 and 2022 stand apart. Companies are building inventories after being caught short during the pandemic. Moreover, the great supply chain shift has pushed more companies toward a build-here, sell-here strategy. That has, at least for now, created demand many in the industry haven’t seen in decades. A fabricator that can deliver has no shortage of opportunity.

The ability to deliver, though, remains a challenge. The latest benchmarking survey showed a drop in average on-time delivery, from 87% in fiscal 2020 to 77% in fiscal 2021. Meanwhile, average sales per employee increased to more than $242,000, and both direct and indirect labor costs (relative to sales) decreased. Meanwhile, direct material costs increased to 39% of sales, up from 34% in fiscal 2020.

FMA is also releasing its annual “Salary/Wage & Benefit Survey,” reporting data from 2022 that, not surprisingly, show upward wage pressures across the board. Wages for forklift operators increased by almost 20% between 2019 and 2022. Similar increases can be seen for entry-level brake, laser, and punch press operators.

All this paints a picture of an increasingly productive industry. Software and automation are likely contributing to those increases in sales per employee and decreases in labor costs, but as 2022 stats show, further wage increases are on the horizon. This isn’t a bad thing, especially if fabricators can match those increases with greater productivity. Technology (combined with good management and lean thinking) are helping fabricators do just that.

Kallage’s “small numbers” problem remains, though—that is, too much revenue coming from just a few customers. How this happens is no secret. While the barrier to entry in fabrication might be a little lower now, the cost to upgrade to the latest equipment is higher than ever. It’s money well spent, considering just how productive modern software and machines are. But it also means that shops hunt for those “whale accounts” to fill those expensive machines with work. Such contract work is still high mix (few order a bajillion parts at a time anymore), but it also opens the door for more value-added services like assembly and supply chain management.This situation can create two different business models under one roof. One is prototyping and component manufacturing, which can have widely varying margins based on supply and demand. A fabricator can charge a pretty penny if someone needs a part yesterday and they can’t find anyone else who can respond quickly. Conversely, a host of fabricators with open capacity create a buyer’s market.

The other business model involves contract work, shop floor “stabilizers” that offer consistent profits (not too high or low) and, ideally, steady or at least predictable work to keep machines busy and (with strategic use of filler parts on nests) material yield high. Those big contracts, however, can push revenue concentration higher. What happens when one of them goes away?

Consider all the ingredients: high revenue concentration; capital spending trends and the increasing importance of automation; rising labor costs; increasing material and other commodity costs, not all of which can be passed on to customers. Add a dash of potential from Industry 4.0, artificial intelligence, and machine learning, where larger and larger data sets become more powerful. Finally, drop in a few innovations in M&A that streamline the acquisition process (Cadrex Manufacturing Solutions is a prime example).

Stir these all up, and you find you’ve got a stew with ingredients that taste better together: greater purchasing power, lower revenue concentration, and enough data and intelligence to make the ideals behind Industry 4.0 a reality. That’s consolidation’s true potential.

For the latest surveys and other resources from the Fabricators & Manufacturers Association, visit store.fmanet.org.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

Related Companies

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/30/2024

- Running Time:

- 53:00

Seth Feldman of Iowa-based Wertzbaugher Services joins The Fabricator Podcast to offer his take as a Gen Zer...

- Industry Events

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI

Precision Press Brake Certificate Course

- July 31 - August 1, 2024

- Elgin,