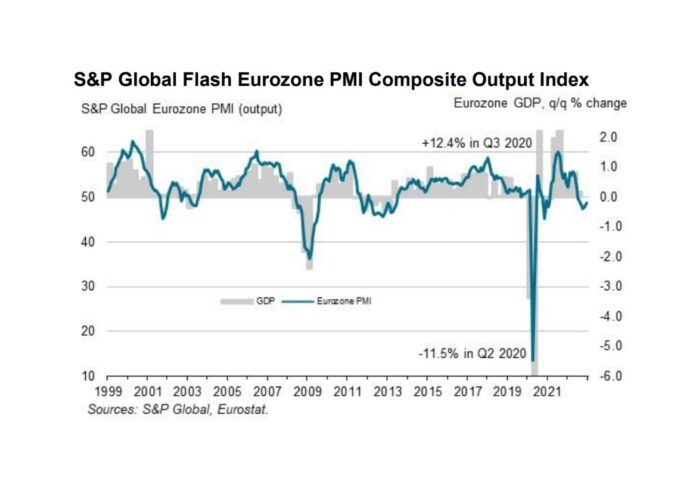

Eurozone’s PMI Composite Output Index saw a significant increase for the second consecutive month, increasing from November’s 47.8 to a four-month high of 48.8.

Despite remaining in the contraction territory of below 50.0 points and reflecting a sixth successive fall in market activity, the result now indicates an easing in the rate of contraction for two months in a row, according to the S&P Global Flash Eurozone PMI report.

The moderated decline in business activity nevertheless means that the fourth quarter as a whole has seen a worse performance than the third quarter.

The average PMI for the December quarter indicates the sharpest economic contraction since 2013, excluding the results of the pandemic lockdown months.

Meanwhile, as manufacturing continued to lead the downturn, the decline rate of production eased, indicating a further cooling in the pace of contraction compared to October’s steep fall.

The zone’s manufacturing output index rose to 47.9, reflecting a six-month high.

The decline in Europe’s output was broad-based but only France saw a deepening downturn, with its composite PMI slipping from 48.7 to 48.0, signalling a second consecutive monthly drop in output and the largest decline since November 2014, excluding pandemic results.

Germany saw rates of decline moderate across both manufacturing and services, pushing its composite flash PMI up for the second month in a row from November’s 46.3 to 48.9.

“The manufacturing downturn has moderated especially markedly in December, led by Germany and linked to a combination of improving supply conditions and reduced fears of energy constraints,” said Chris Williamson, chief business economist at S&P Global Market Intelligence.

Outlook for inflation has also seen a positive turn, with supply chains now improving for the first time since the pandemic began, Williamson said.

“The downside is that this improving inflation outlook is primarily a symptom of falling demand, which has removed pricing power from many companies and their suppliers, and the business environment remains one in which confidence remains very subdued by historical standards. Thus, while the downturn is looking likely to be less steep this winter than previously anticipated by many, there remain few signs of any meaningful return to growth evident as 2022 comes to an end,” the economist said.