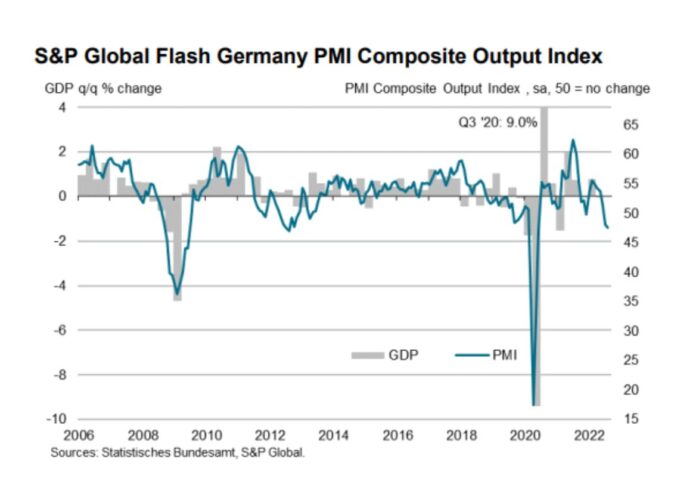

Market activity in Germany’s private sector slipped for the second consecutive month and at a faster rate, according to the S&P Global’s Flash purchasing managers’ index report.

Germany’s PMI Composite Output Index dropped further into sub-50 contraction territory in August, down 48.1 in July to 47.6. The report also showed a continuing decline in service sector activity, which stands at an 18-month low of 48.2 from 49.7 in July.

In the manufacturing industry, the rate of increase was down notably from last year’s record highs. This was reportedly due to a softening of some material prices and a further easing of supply bottlenecks.

The country also saw a downturn in export sales, with goods producers recording the steepest drop in new business from abroad in two years midway through the third quarter of 2022.

Surveyed businesses attributed the continuing downturn to a variety of factors, including uncertainty, high inflation and rising interest rates.

This month’s slow business activity was also attributed to high stock levels at customers, which led to the cancelling or postponement of new orders across the manufacturing sector.

Meanwhile, firms’ expectations surged from July’s results amid a further easing of rates of increase in businesses’ costs and output prices.

However, confidence remained subdued and well below the level seen prior to Russia’s invasion of Ukraine, S&P Global’s report noted.

“The slowdown in the economy is increasingly taking a toll on firms’ hiring activity, with employment growth easing to its weakest for almost a year-and-a-half in August. A first fall in backlogs of work for more than two years points to capacity pressures across Germany’s private sector economy starting to ease and represents a downside risk to job creation going forward,” said Phil Smith, economics associate director at S&P Global Market Intelligence.

“Positively, August’s data provided evidence of a further easing of both supply side constraints and cost increases, which helped to lift business confidence from July’s recent low. However, with the threat of an energy crisis still looming large, the outlook remains riddled with uncertainty,” Smith added.