Over the years, the packaging industry has evolved into a saturated market where its growth mostly depends on the sectors it caters to – in this case, virtually every sector! Hence, companies operating in the industry have limited opportunities/alternatives to expand and maintain competitiveness. This leads to an increasing number of companies adopting inorganic growth strategies. Mergers & acquisitions (M&As) not only facilitate corporate growth in a shorter timeframe but also aid in leveraging the strengths and resources of the entities involved.

Very recently, in September 2023, Smurfit Kappa and WestRock announced a $11.2 billion merger that is anticipated to close in July 2024. Smurfit Kappa and WestRock, with their respective leadership positions in the Europe and Americas paper & paperboard packaging markets, are expected to form a “truly global company” while also transforming into the largest packaging company globally. The evolution of both companies was discussed in detail in The Dynamics of Mergers & Acquisitions in the Packaging Industry.

Interestingly, in March 2018, U.S.-based International Paper Company (IPC) intended to acquire Smurfit Kappa for approximately $10.4 billion but the bid was rejected by the latter’s management. Fast-forward to March 2024, and IPC entered a bidding war with Mondi plc to acquire UK-based paper packaging producer, DS Smith. A month later, in April 2024, IPC announced the agreement to acquire DS Smith for approximately $7.2 billion and is expected to close by Q4 2024.

The Smurfit-WestRock and IPC-DS Smith deals are similar– both are transatlantic agreements between two strong regional players aiming to create a ‘global packaging company.’ The packaging industry has long operated in geographic silos with companies strengthening their operations in specific regional markets. Hence, these two deals indicate the start of a globalization trend in the packaging industry via inorganic mode. Frost & Sullivan anticipates more multi-billion-dollar deals in the coming years, consolidating in the industry.

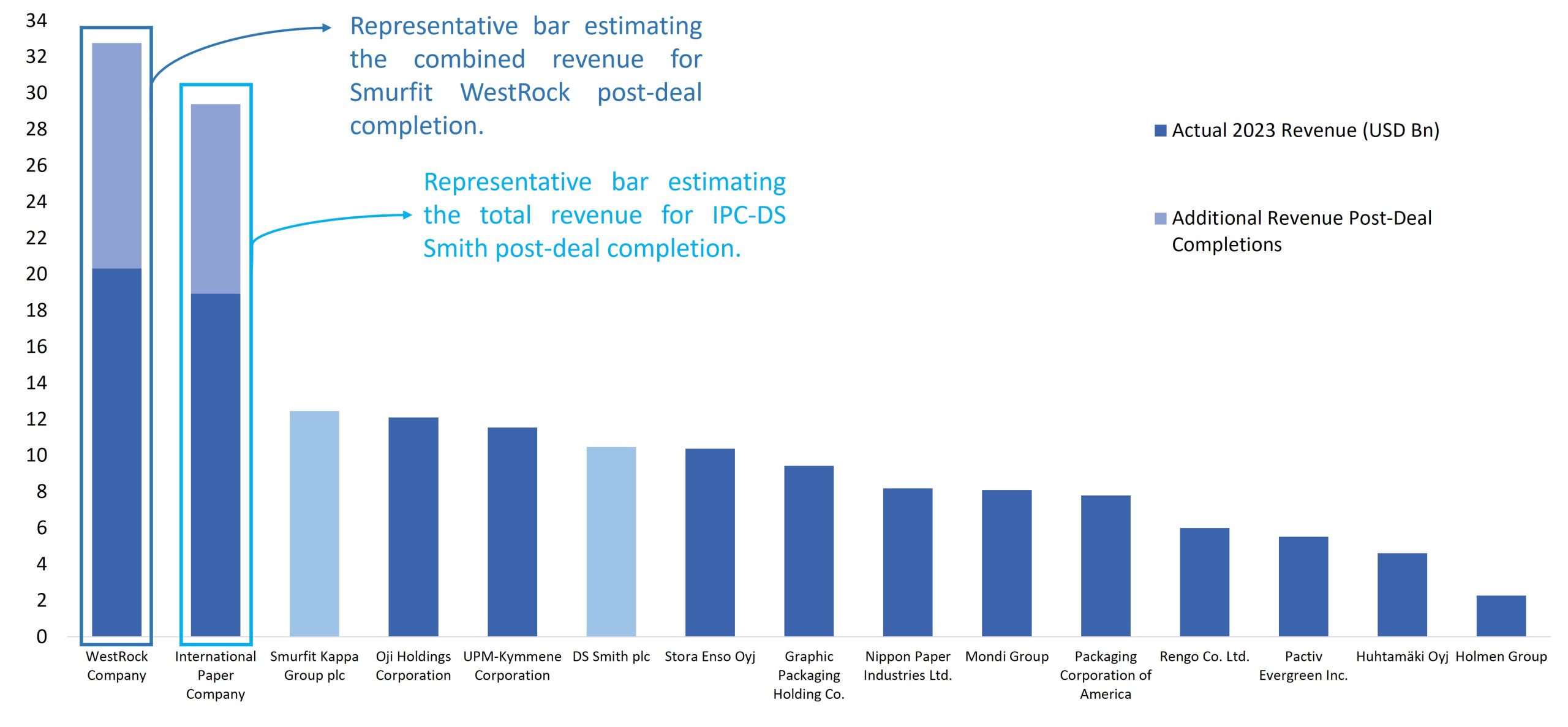

Until 2023, WestRock and International Paper Company were the two largest packaging producers globally, from a revenue perspective. Upon completion of their respective integrations, Smurfit-WestRock is expected to become the largest packaging company followed by IPC-DS Smith. This shuffles the competitive landscape of the packaging industry, widening the revenue gap between the combined entities and independently operating producers. Further, the combination of IPC-DS Smith is expected to have a production capacity of nearly 18 Mn MT (13 Mn MT – IPC; 5 Mn MT – DS Smith) second only to Smurfit WestRock’s production capacity of over 23.1 Mn MT (14 Mn MT – WestRock; 9.1 Mn MT – Smurfit Kappa).

Figure (a) organizes the top 15 paperboard & packaging producers based on their 2023 revenues and provides a representative competitive scenario post-deal completions.

Figure (a). Frost & Sullivan

While mergers & acquisitions are commonplace in the paper packaging market, deals like these accelerate the consolidation of the industry. M&As will certainly continue to provide lucrative growth opportunities for paper and packaging producers over the coming years; however, it remains to be seen whether the consolidation efforts will remain focused on the transatlantic passage or spread to Asia Pacific too.

Does your company have a strategy to capitalize on the inter-material competition within the food packaging sector? Check out our latest study on Food Packaging Growth Opportunities.

About Frost & Sullivan:

Frost & Sullivan, the growth pipeline company, enables clients to accelerate growth and achieve best-in-class positions in growth, innovation, and leadership. The company’s Growth Pipeline as a Service provides the CEO’s Growth Team with transformational strategies and best-practice models to drive the generation, evaluation, and implementation of powerful growth opportunities. Let us coach you on your transformational journey, while we actively support you in fostering collaborative initiatives within your industry’s ecosystem. Our transformation journey is fueled by four powerful components, ensuring your success in navigating the ever-changing landscape of your industry.

- Schedule a complementary Growth Dialog with our team to dive deeper into transformational strategies and explore specific needs within your company.

- Become a Frost Growth Expert in your area of specialization and share your expertise and passion with the community through our think tanks.

- Join Frost & Sullivan’s Growth Council and become an integral member of a dynamic community focused on identifying growth opportunities and addressing critical challenges that influence your industry.

- Designate your company as a Companies2Action to increase exposure to investors, new M&A opportunities, and other growth prospects for your business.