Whether or not the financial tightening of the Federal Reserve results in a “soft landing” — slowing down the economy to reduce inflation and not cause a recession — remains to be seen. For now, any positive data in the first quarter could be transitory. The economy has shifted into low gear. Economic fundamentals provide insights for U.S. moldmaking.

Interest Rates

Monetary policy is known to work with a lag. This means there is a delay between when monetary policy is enacted and when the effects on the economy are felt. Raphael Bostic, president of the Federal Reserve Bank of Atlanta, points to 18 months to two years or more for tighter monetary policy to influence inflation. However, a recent Federal Reserve Bank of Kansas City study shows that the lag could be shorter— results could be seen as soon as one year after policy tightening. The Federal Reserve (Fed) began tightening monetary policy in March 2022. Last March, the Fed continued to raise the Fed funds rate, the economy’s benchmark interest rate, by another 25 basis points, taking the Fed funds to its current target rate of 4.75-5.00%. This means that the U.S. prime lending rate is now 8.00%.

Based on the Fed’s preferred measure of inflation, the Personal Consumption Expenditure Price Index, inflation was down to 5.00% in February 2023 from its 7.00% peak in June 2022. Given the Fed’s inflation target of 2.00%, more work needs to be done to bring prices down to a rate that maximizes economic growth.

Monetary policy affects the macroeconomic fundamentals or the underlying factors influencing economic performance. By extension, changes in monetary policy affect the manufacturing sector — and moldmaking is no exception. A pullback in economic activity or decreased economic output constrains manufacturing growth. The latest forecasts point to a U.S. economy that is downshifting against higher borrowing costs, affecting the economy’s household and business sectors.

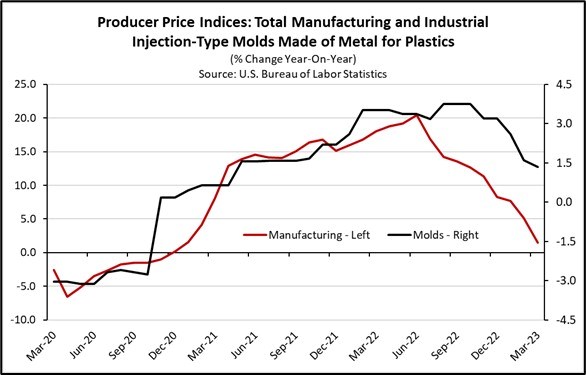

Looking at both indices over the past 12 months, ending with March 2023, shows that, by and large, moldmaking and plastics product manufacturing moved in the same direction as can be expected.

Economic Output

The International Monetary Fund (IMF) released its latest forecast of U.S. output measured by gross domestic product (GDP). The IMF expects U.S. GDP to grow by 1.6% this year and 1.1% next year. My forecast is more anemic than that of the IMF. U.S. economic growth could cap at 1.0% this year and 1.1% next year. Personal consumption expenditure (PCE), roughly 70.0% of the U.S. GDP, slowed last year and in the first quarter of this year. Following a 2.0% increase in PCE in January from December, PCE in February grew a marginal 0.2%. A pullback in consumer spending has cascaded upstream. Businesses adjust inventory levels to demand. Lower consumption translates to rising inventory, all else equal, and consequently requires lower manufacturing output.

While PCE in Q1 2023 is still missing the March data, there are visible signs of lower consumption: retail sales. While the financial market reacted positively to strong January retail sales, which increased by 2.8% after a disappointing 1.1% decrease in December, they flattened in February before they decreased by 1.2% in March. While retail sales rose 3.8% in Q1 2023 from a year earlier, weaker growth in retail sales can be expected in the remaining quarters of 2023 as growth in personal disposable income continues to slow. Also, the higher cost of borrowing is expected to generate consumption pullback ahead. PCE growth could top 1.3% this year and 1.0% next year. This could only mean lower manufacturing output ahead. The latest jobs report supports such a narrative.

Employment

Recent data already supports weaker manufacturing activity ahead. The U.S. Bureau of Labor Statistics’ jobs report in March continues to underscore the strength of the labor market. The unemployment rate was 3.5%. The unemployment rate in manufacturing was 2.9% and the unemployment rate in plastics and rubber products manufacturing was 4.5%. However, it is unlikely that the 1.034 million jobs added in Q1 2023 will be replicated in Q2. The economy’s labor participation has barely increased — averaging 62.3% in the last 12 months from 61.9% 12 months prior.

More importantly, the goods-producing sector of the economy dropped 7,000 jobs in March, in contrast to the 41,000 and 11,000 jobs added in January and February, respectively. The services sector, however, added 196,000 jobs in March — following the 312,000 and 255,000 jobs added in January and February, respectively.

While the U.S. labor market remains strong and seems resilient, a clear bifurcation exists between the manufacturing and the services labor markets. The former is losing jobs and the latter is adding jobs. Strong demand in the services sector necessitates additional labor to service the demand. The opposite is happening in the manufacturing sector. Lower demand has caused producer prices to fall.

Inflation

Demand-pull and cost-push inflation occurred simultaneously beginning in 2021, which caused rapid price escalation. The former was caused by the fiscal stimulus to the household sector, which led to the demand for goods outpacing the supply. The supply chain bottlenecks caused the upward price pressures of the latter due to the COVID-19 pandemic. The easing of the supply chain and the pullback in consumer demand has decreased inflation by most measures.

Headline inflation, measured by the year-on-year change in the Consumer Price Index, was 5.0% in March — down from its 9.0% peak in June last year. Core inflation, which excludes volatile energy and food prices, was 5.0% in March — down from its 6.6% peak in September last year. Not only were retail prices lower in March, but prices at the manufacturers’ gate also decreased.

The Producer Price Index (PPI), a measure of the average change in the selling prices received by domestic producers for their output, has also decreased in recent months. The year-on-year change in the PPI for total manufacturing industries was 1.5% in March, as shown in the accompanying graphic. It was a significant decrease from its 20.4% peak in June 2022.

While the PPI for industrial injection-type molds made of metal for plastics did not increase significantly, it decreased to 1.3% in March, year-on-year, from its 3.7% peak in August 2022. The opposite of what happened to demand and supply in 2021, which caused prices to increase significantly, is taking place in the economy today — causing inflation to fall — albeit still above the Fed’s inflation target.

GBI and Total Manufacturing

The economy’s manufacturing sector is the primary customer of many industries. The plastics industry is an example. One would expect that changes in the economy’s manufacturing outlook affect the value chain of many industries. Two indicators of manufacturing activity — the Industrial Production Index for manufacturing, which captures manufacturing activities in the North American Industry Classification (NAICS), and the Industrial Production Index for plastics product manufacturing — hold clues for U.S. moldmaking.

Monthly variations in moldmaking activity are observable in the monthly Gardner Business Index (GBI) Moldmaking, provided by Gardner Intelligence. To a certain extent, GBI and the Industrial Production Index for manufacturing move in the same direction. For instance, GBI Moldmaking saw upticks of 2.0, 0.5 and 1.2 points in January, February and March, respectively, this year. While the economy’s Industrial Production Index for manufacturing witnessed upticks of 1.5 and 0.7 points in January and February, respectively, in sync with GBI Moldmaking, it decreased by 0.5 points in March. Despite a divergence in the final month of Q1 2023, the underlying trends of both indices were moving in the same direction.

While the U.S. labor market remains strong and seems resilient, a clear bifurcation exists between the manufacturing and the services labor markets.

GBI and Plastics Product Manufacturing

Comparing the GBI to the Industrial Production Index for plastics product manufacturing shows that both increased by 1.2 and 1.5 points, respectively, in March. Plastics product manufacturing held steady in February, decreasing marginally by 0.1 point. The GBI increased by 0.5 point in the same month. Looking at both indices over the past 12 months, ending with March 2023, shows that, by and large, moldmaking and plastics product manufacturing moved in the same direction as can be expected.

GBI Moldmaking gained 1.2 points in March — following 2.0 and 0.5 point gains in January and February, respectively. In March, the GBI at 50.9 barely surpassed the growth threshold of 50. A weaker economic outlook translates to weaker growth momentum for U.S. moldmaking in the near term. Forecasts change and are subject to revisions. The current outlook for 2024 calls for increased production across the plastics industry value chain — including molds for plastics.

Related Content

Transforming Moldmaking into Digital Industrial Manufacturing

Moldmaking and digitalization is at the core of this global industrial manufacturing company’s consolidation and diversification plan.

Read MorePredictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreWomen Impacting Moldmaking

Honoring female makers, innovators and leaders who are influencing our industry's future.

Read MoreSteps for Determining Better Mold Prices

Improving your mold pricing requires a deeper understanding of your business.

Read MoreRead Next

Internal and External Factors Continue to Impact U.S. Moldmaking

Sustainable growth remains in the forecast as economic conditions continue to progress.

Read MorePlastics Industry Association Releases Global Trends Report for 2022

The Plastics Industry Association’s Global Trends report provides an account of U.S. plastics exports and imports in four categories.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More

_300x250 3.png;maxWidth=300;quality=90)

.png;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)