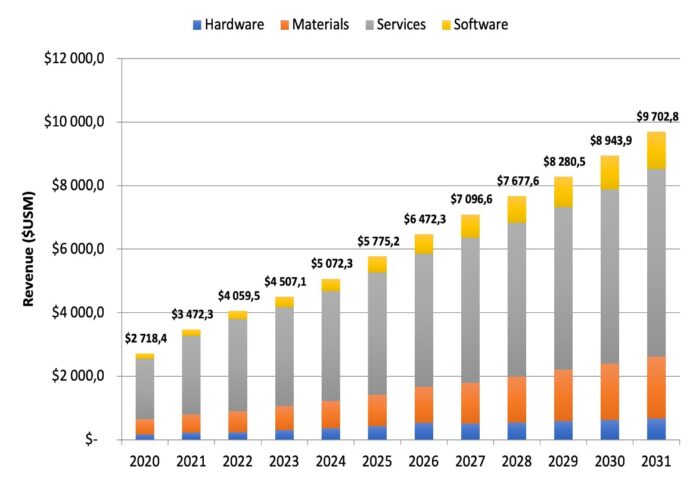

A recent report from SmarTech Analysis revealed that the global dental 3D printing industry is expected to grow from $4 billion in 2022 to slightly over $9.7 billion by 2031, accounting for nearly one-third of the overall additive manufacturing (AM) market.

In a press release, the market forecaster stated that when the value of printing by laboratories and production centres is taken into consideration, dental printing accounts for approximately 30 per cent of the whole AM market.

The paper, titled “3D Printing in Dentistry 2023: Market Study & Forecast,” analysed trends in the larger dental sector that have evolved since the COVID-19 era upheaval faded and provides a glimpse into the future of the dental printing business.

The study and associated market database also include dental printing hardware advancements, competitive landscape and tactics, industry segmentation, and future scenarios driving both growth and problems that existing market participants will encounter.

Companies mentioned within the report and data include BEGO, Dentsply Sirona, Whip Mix, DMG, Straumann, Ivoclar, 3D Systems, Stratasys, Desktop Health (ETEC), DWS, Formlabs, SprintRay, Asiga, Structo, Trumpf, EOS and EPlus.

According to SmarTech, the global industry for additive manufacturing would produce roughly $13.5 billion in revenue by 2022.

The paper also found that the market for dental 3D printing is seeing intense competition, which is reviving 3D printing technology development.

Many instances of these dynamics can be seen in the printing industry, ranging from seemingly insignificant printer features that can help cut costs even further or increase user friendliness to wholly new solutions that can gain market share based on brand-new ideas from a customer base that will soon include sophisticated printing end users, SmarTech stated.

To date, the study said the dentistry sector is determining whether traditional 3D printing players will be successful as independent solution developers or if the established dental solution providers will eventually pick up the development slack.

For more information on the report, you may visit this link.